Double-Edged Business Model

iomando operates a double-sided business model that provides a classic markup sale for distributors, but also enables a SAAS to run on top — which was the result of several failed attempts to fit a software-based solution within a traditionally hardware-based industry.

Investors looking for new deals ask a lot of questions. A never-ending list ranging from an exhaustive, technical audit of the business to the most mundane morale and relationship’s health of the founders.

There’s one question though, one they always ask, that keeps me awake at night.

How do you protect your business from other competitors, or in startup parlance, what’s the unique trait about your business that makes you the most likely to succeed.

The reason why, for a long time, I’ve struggled to answer this question is that I’ve been framing it wrong. As an engineer by trade, when it comes to protection, I’ve always thought of the technology as the solution that would eventually fix it all: understand the problem better than your competitor, build a great product and “they will come”.

This assumption, I’ve learned, is perfectly flawed.

It presumes an ideal scenario where the product or the technology is not constrained by any other factor, it is all there is. Yet constraints are all over the place. Protecting a business exclusively with technology might be possible to an extent — especially in the early stages — but definitely not in the long run.

When investors ask for defensibility they are implicitly asking for an “unfair advantage” — what do you know that others don’t. They are trying to asses whether you have already studied the end game.

Each time I was asked along these lines I started to ramble around technology, only interrupted a few seconds later with the inevitable “so anyone could do it, right?” — they were not expecting a technical answer.

Again, I had a hard time making my head around this one and only learned it the hard way.

Technology is not an end by itself. It should be rather the support function for something bigger: the business model. Only when business model and technology work together towards a certain vision, incentives are aligned.

Easier said than done though. There are many factors at play, but the creativity required to come up with a unique, innovative business model usually derives either from being an insider or naive enough not to know what you’re doing. Outsmart any given market is not an easy endeavor if you don’t fully understand its in and outs beforehand.

Bringing the conversation back to iomando, we chose the latter, the naive route. We entered the access control market with a new technology assuming that “everybody’s wrong, but we know how this should be done“.

Of course, we knew nothing.

We built a product for a market that we recreated in our minds. We didn’t consider how the market was shaped, and we were confident our product would just fit “out of the box”.

The way out of this situation was to distill the core nature of our product, find something unique, and leverage it in order to create something our competitors could not replicate.

iomando’s uniqueness was its software-based nature — within a traditionally hardware-based industry. This characteristic both defined and limited us when it came to delivering on our value proposition. But still, it was the best shot we had to lay out the foundation upon which to build a sustainable business model.

We also had to account for how our sales channels already operated: distributors were still the gateway to reach small, disaggregated customers. Yet they weren’t used to work with software. They understood and were incentivized by markup over sales, not future subscription revenues.

Our distributors didn’t speak LTV. They spoke installation cost, that was their bread and butter and what their customers were used to pay for. Thus we had to create a model for iomando that fit their expectations and the way they were used to do business.

We course corrected and split our hardware and software operations. We let installers play their own rules and manage the hardware side of the business — alongside the customer service relationship.

This way distributors benefited from a huge markup on every sale, which included the electronic unit plus the installation. This is the way this industry has operated since forever, and this is the way iomando makes some room for itself.

And here comes the best part: regardless of how the sale was managed, iomando remains a software-based solution.

This means that we could deliberately sell the electronic unit at a cost — because we would get our share from the subscriptions — passing down all the margin to the partners. Our distributors were highly incentivized to sell our product because it came with far more revenue associated than usual.

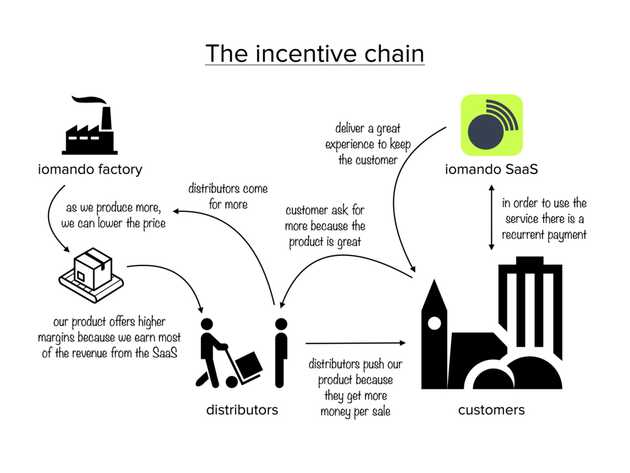

This is why iomando features a double-sided business model that incentivizes each step of the chain:

- Classic markup model for distributors running on the bottom.

- SAAS business managed by iomando, which is high margin, recurrent, and potentially expandable with new offerings.

Every time a distributor installs a device, the device automatically connects to the internet and ties back the customer to our service. This is what enables our customer to make use of the cloud-based service and the mobile apps. The customer is ours, and so is the possibility to deliver a great service and earn a subscription service that could endure for a long time.

But it is also risky. If we wouldn’t deliver a great experience, the customer could cancel the service at any time. And while our installer “doesn’t care” because she has already cashed out the sale, we could be left out with nothing but a couple of subscription payments.

Therefore we are also extremely incentivized to deliver a great service because keeping one customer is worth the same than acquiring a new one.

The doubled-edged model — that both incentivize distributors to push our hardware and keeps us working on delivering the best product — is our way to align our strengths with our business model. And, ultimately, the story we tell investors every time they ask for that question.